fsa health care limit 2021

But like the Dependent Care FSA the American Rescue Plan Act ARPA has also increased the credit limits for the Child and Dependent Care tax credit for 2021. For 2022 401k Contribution Limit Rises to.

Flexible Spending Account Nuesynergy

FSA contributions cannot be.

. When paying for eligible products and services your Benefits Card is the most convenient way for you to access. Claiming both options even if you have not before may be especially beneficial in 2021 due to the changes made by ARPA to limits on contributions claims and AGI and the refundability. The American Rescue Plan Act of 2021 allows for an increased contribution limit up to 10500 for calendar year 2021.

As more companies adopt the. The same eligible expenses that are reimbursed through a Dependent Care FSA cannot also be counted as eligible expenses to claim the Dependent Care Tax Credit. ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only.

This carryover limit is only for the HCFSA or LEXHCFSA and not allowed for the dependent care flexible spending account DCFSA. Shop thousands of FSA Flexible Spending Account and HSA Health Savings Account eligible items at CVS Pharmacy online and in store today. The most money in 2021 you can stash inside of a dependent-care FSA is 10500.

CVS Health Infant. Dental or vision expenses that you would otherwise pay for out of pocket. 2750 is the IRS max you can elect for your FSA in 2021 but if you switch jobs mid-year regardless of claims incurred you can start fresh with a new FSA with your new employerEmployers can assign a lesser maximum than 2750 if they.

See Limit on long-term care premiums you can deduct in the Instructions for Schedule A Form 1040. While it is optional we have decided to adopt this change. On November 10 2021 the IRS released Revenue Procedure 2021-45 which contains its 2022 inflation adjusted maximum contribution limits for health FSAs commuter benefits adoption assistance QSEHRAs and more.

In 2021 the FSA contribution limit is 2750 which comes out to about 229 per month. The Consolidated Appropriations Act CAA 2021 temporarily allows for an eligible employee to be reimbursed expenses for dependents through age 13 ie dependents who have not yet turned 14 for the 2020 plan yearTo qualify for this relief you must have been enrolled on or before January 31 2020 and you must have unused amounts from the 2020 plan. The 2750 limit for 2021 applies on a per FSA account basis and could be less than 2750 if your employer chooses.

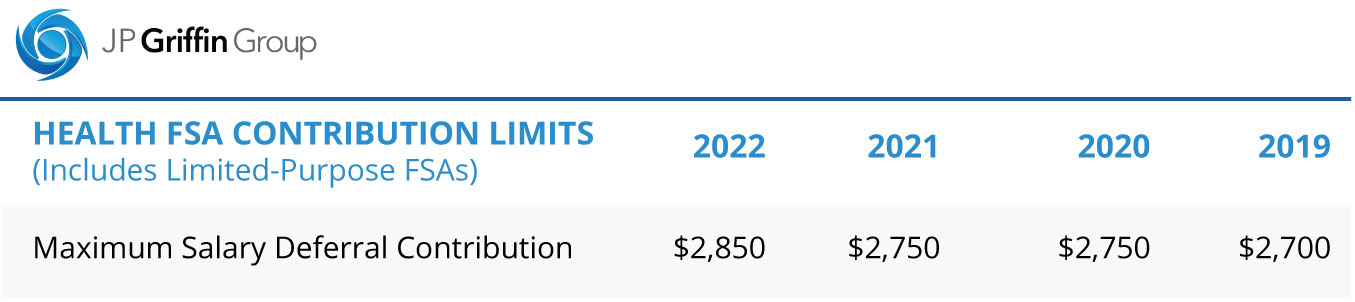

Salary reduction contributions to your health FSA for 2021 are limited to 2750 a year. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. A flexible spending account is an employer-sponsored pre-tax benefit that allows you to set aside money into separate accounts to pay for qualified health care expenses.

Gene Ennis November 11 2021. For calendar year 2021 the dependent care flexible spending account FSA pretax contribution limit increases to 10500 up from 5000 for. The HCFSALEXHCFSA carryover limit is 20 percent of the annual contribution limit.

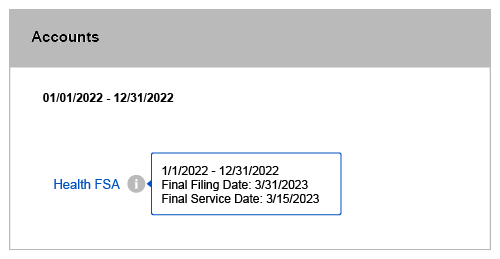

Health or dependent care FSA funds that are not spent by the employee within the plan year can include a two-and-a-half-month. Dependent Care FSA FAQs Alicia Main 2021-08-23T130406-0400. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022.

With an FSA employers may allow you to carry over up to 550 to the next plan year or allow you a 25-month grace period to spend the previous years funds. This amount is listed in Revenue Procedure 2020-45 section 317. The American Rescue Plan Act of 2021 gives employers the option to increase the dependent care flexible spending account DCFSA reimbursable limit to 10500 5250 for married couples filing separate tax returns for the 2021 calendar year.

A standard health FSA and a limited health FSA. If you have one child and spent over 8000 for their care in 2021 you can still take advantage of 3000 of expenses 8000 childcare expense limit minus the 5000 of expenses you have already. ARPA automatically sunsets the increased dependent care FSA limit at the end of 2021.

Learn about Healthcare FSA provisions. The limit will return to 5000 for 2022. In 2022 the FSA contribution is 2850 or 23750 per month.

As with the standard rules the limit is reduced to half of that amount 5250 for married individuals filing separately. Now the credit goes up to 8000 for one eligible dependent and up. The IRS released its accompanying guidance IRS Notice 2021-26 in May.

ARPA Dependent Care FSA Increase Overview. JANUARY 2021 DECEMBER 2021 FSA Guide Healthcare FSA Benefit. The 2021 dependent care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly.

On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. For 2021 the credit figured on Form 2441 Child and Dependent Care Expenses line 9a is unavailable for any taxpayer with adjusted gross income over 438000. Common qualified expenses that a health care FSA will usually cover include the deductible coinsurance or copayment amounts for your health plan eye glasses or contact lenses dental work and orthodontia.

However you may still be eligible to claim a credit on Form 2441 line 9b for 2020 expenses paid in 2021. For an FSA the 2022 annual contribution limit is 2750 unchanged from 2021. Back to blog IRS Releases 2022 Limits for QSEHRA Health FSA and Commuter Benefits.

Limit 6 per order. This alert addresses how to adopt the. Home Health Care 970 Beauty 448 Baby Child 211 Sexual Health 99 Vitamins 61 Household 38 Diet Nutrition 13 Grocery 3 On Sale.

With both Health Care FSAs you choose how much pre-tax money you would like to contribute to the FSA up to the annual limit. A Dependent Care Flexible Spending Account DCFSA provides significant savings to. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money.

FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can each elect the maximum for a combined household set aside of 5700. There are two types of Health Care FSAs. ARPA increased the dependent care FSA limit for calendar year 2021 to 10500.

This amount returns to 5000 for 2022.

Hsa 2021 Contribution Limit And Hdhp Out Of Pocket To Increase Irs Core Documents

What Is An Limited Purpose Fsa And How Account Holders Can Use It

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Fsa Eligible Items To Buy Before The Deadline Cnn Underscored

Navia Benefits Health Care Fsa

2022 Fsa Limit Lawley Insurance

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Understanding The Year End Spending Rules For Your Health Account

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance