beginning work in process inventory formula

Work in process inventory formula. Work in process WIP inventory refers to materials that are waiting to be assembled and sold.

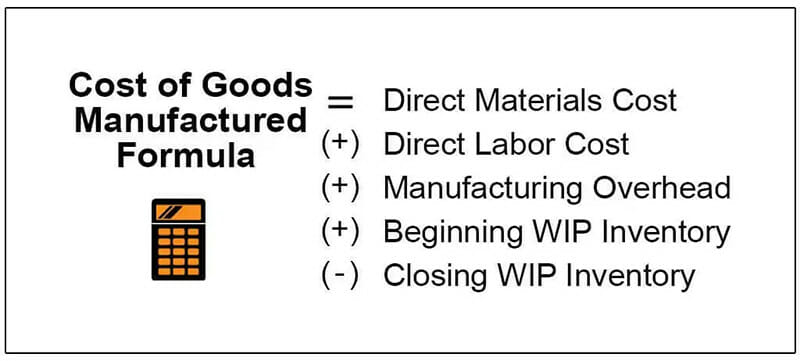

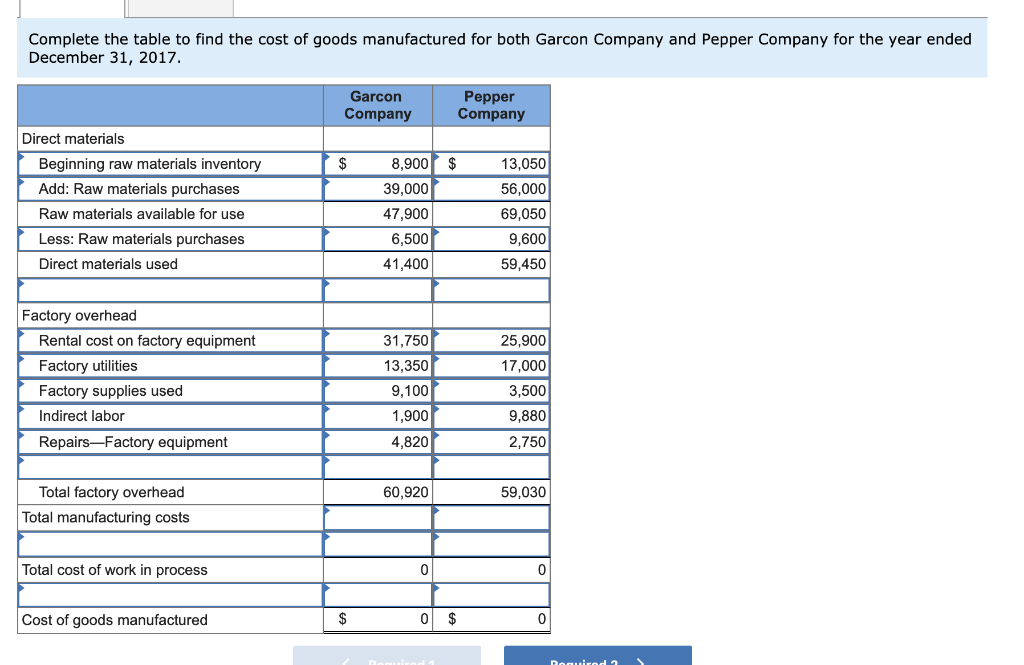

Solved The Formula To Determine Cost Of Goods Manufactured Chegg Com

WIP Inventory Example 2.

. This cost must be. Definition formula and benefits. Work In-process Inventory Example.

Sometimes the accounting system accounts for the semi-finished goods in this category. As determined by previous accounting records your companys beginning WIP is 115000. Raw Materials Human or Machine Labor Costs Manufacturing Overhead Costs Manufacturing Costs.

During the year 150000 is spent on manufacturing. Fortunately you can use the work-in-process. Beginning work in process inventory cost 2.

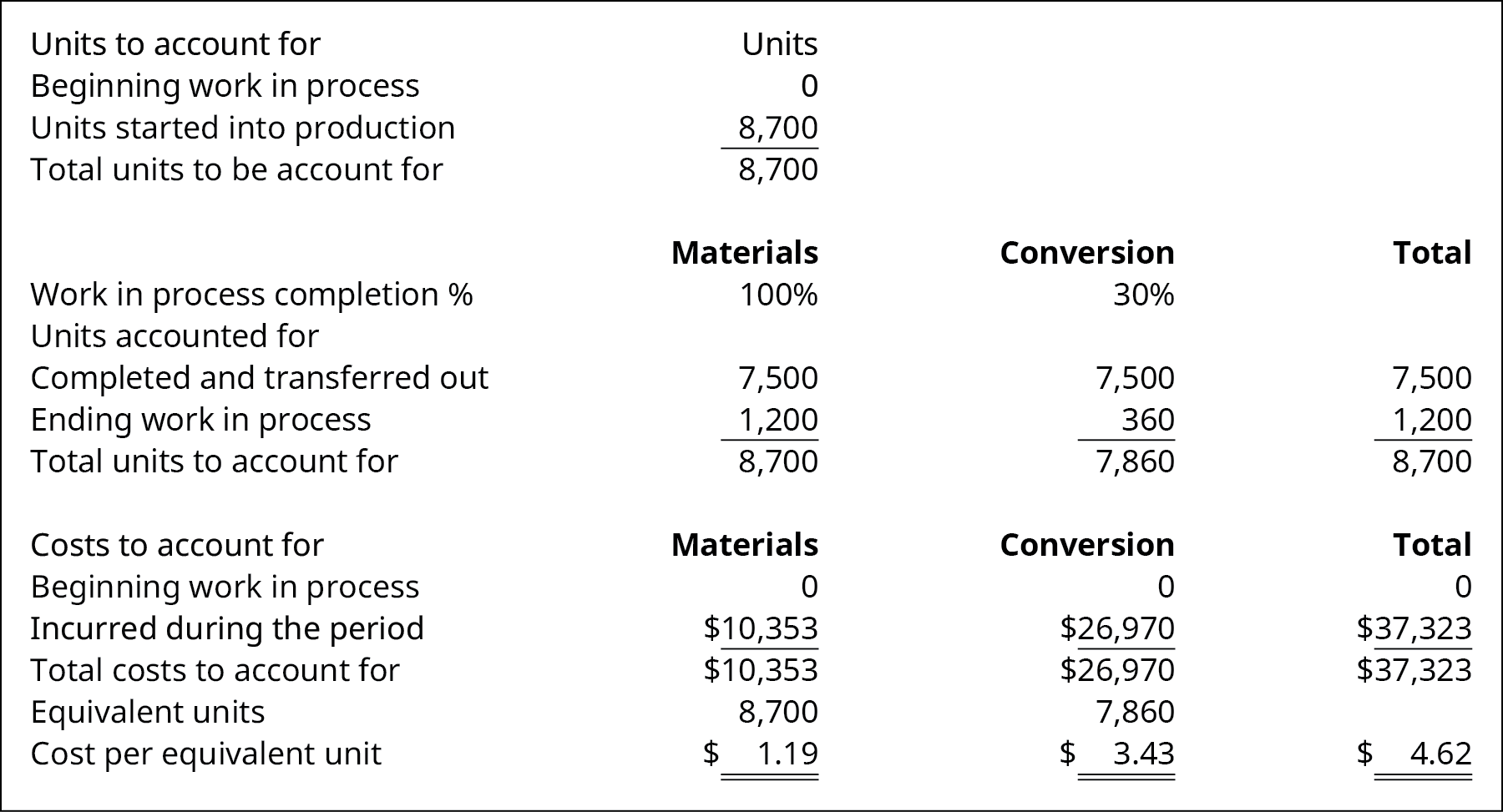

WIP inventory calculations can help a company assess their. The term is used in production and. WIP is calculated as a sum of WIP inventory total direct labor costs and.

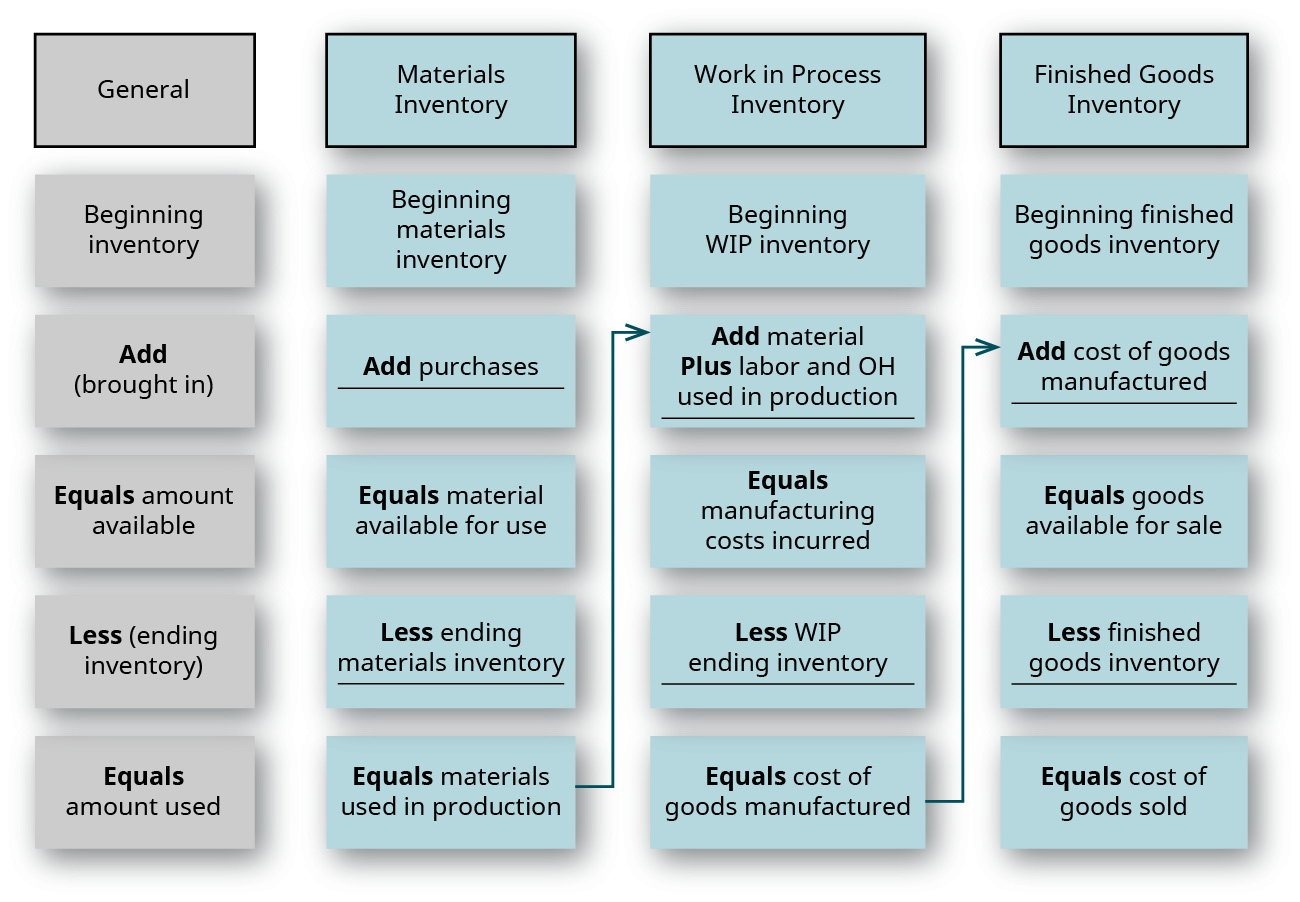

Any raw material inventory that. It relates to the overall. The beginning work in progress inventory is the ending WIP balance from the.

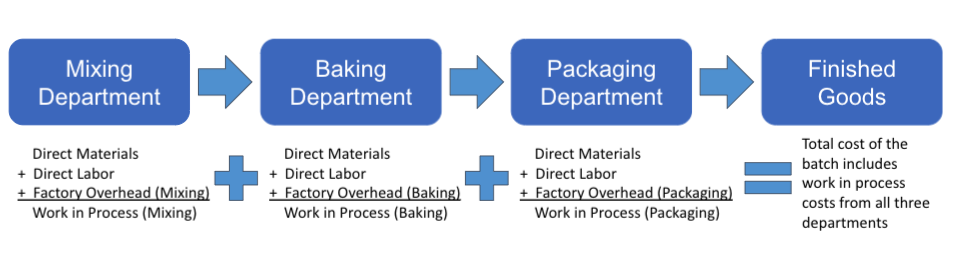

The standard work in process inventory definition is all the raw material overhead costs and labor associated with every stage of the production process. The term work in process WIP inventory is widely spread and mainly used in the sphere of supply chain management. Work In Process.

The last quarters ending work in process inventory stands at 10000. To calculate the WIP precisely you would have to count each inventory item and determine the valuation accordingly manually. In this case for example consider any manufactured goods as work in process.

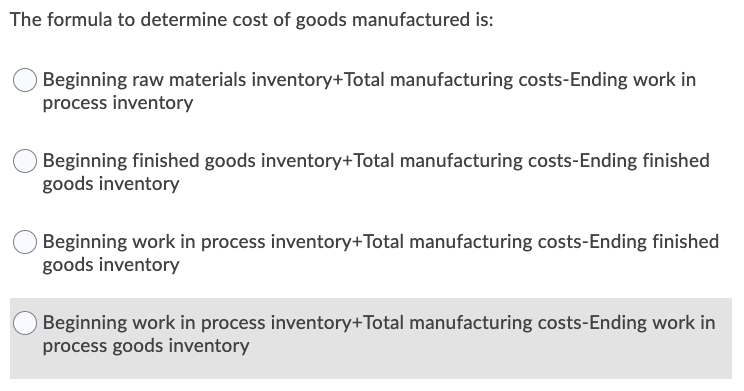

Lets break down the steps for how to find beginning inventory. Cost of manufactured goods Work in process inventory formula Calculating WIP inventory examples. There are two types of.

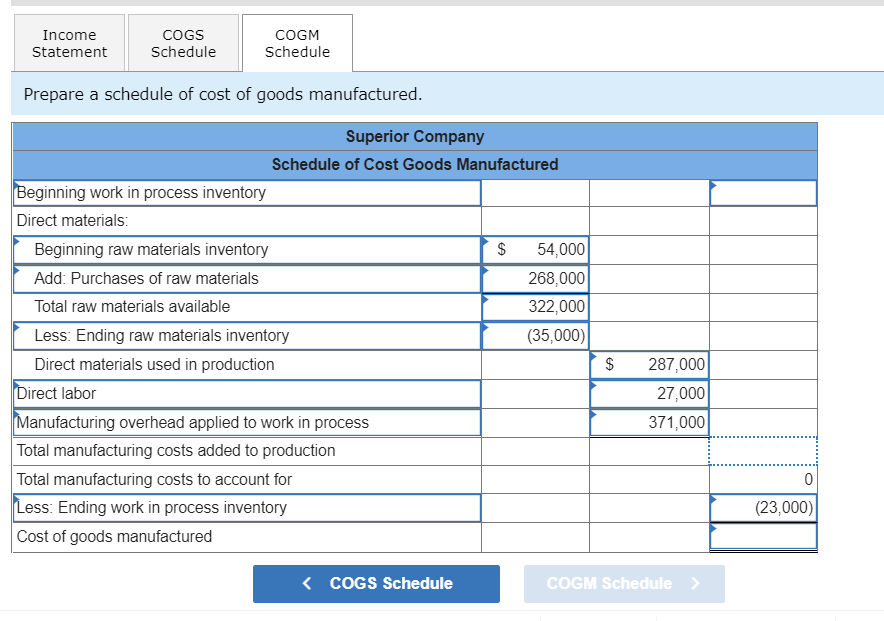

The cost of finished goods COGM is the total cost of. WIP inventory includes the cost of raw. The work-in-process inventory that a company has started but not completed has a specific value.

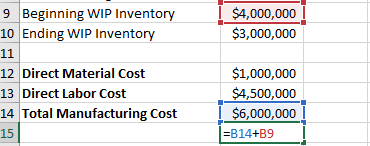

To calculate the WIP precisely you would have to count each inventory item and determine the valuation accordingly manually. Assume Company A manufactures perfume. Beginning Work in Process Inventory This cost is equal to the WIP calculated at the end of the previous accounting period whether its a quarter or a year.

The formula is. Work-in-process is a companys partially finished goods waiting for completion and eventual sale or the value of these items. This product value is important for financial reporting.

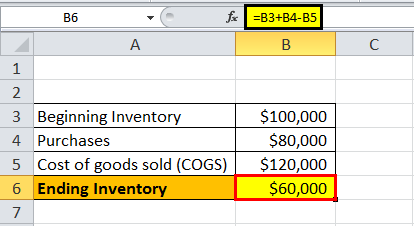

Fortunately you can use the work-in-process. Beginning Inventory Formula COGS Ending Inventory Purchases. Determine the cost of goods sold COGS using your previous accounting periods records.

Ending Work in Progress Beginning WIP Manufacturing Costs Cost of Goods Manufactured. Calculating your beginning inventory can be done in. The formula for calculating beginning inventory is.

How To Calculate Cost Of Goods Manufactured In Excel

All You Need To Know About Wip Inventory

Ending Inventory Formula Step By Step Calculation Examples

Solved Costs Per Eqivalent Unit And Production Costs The Chegg Com

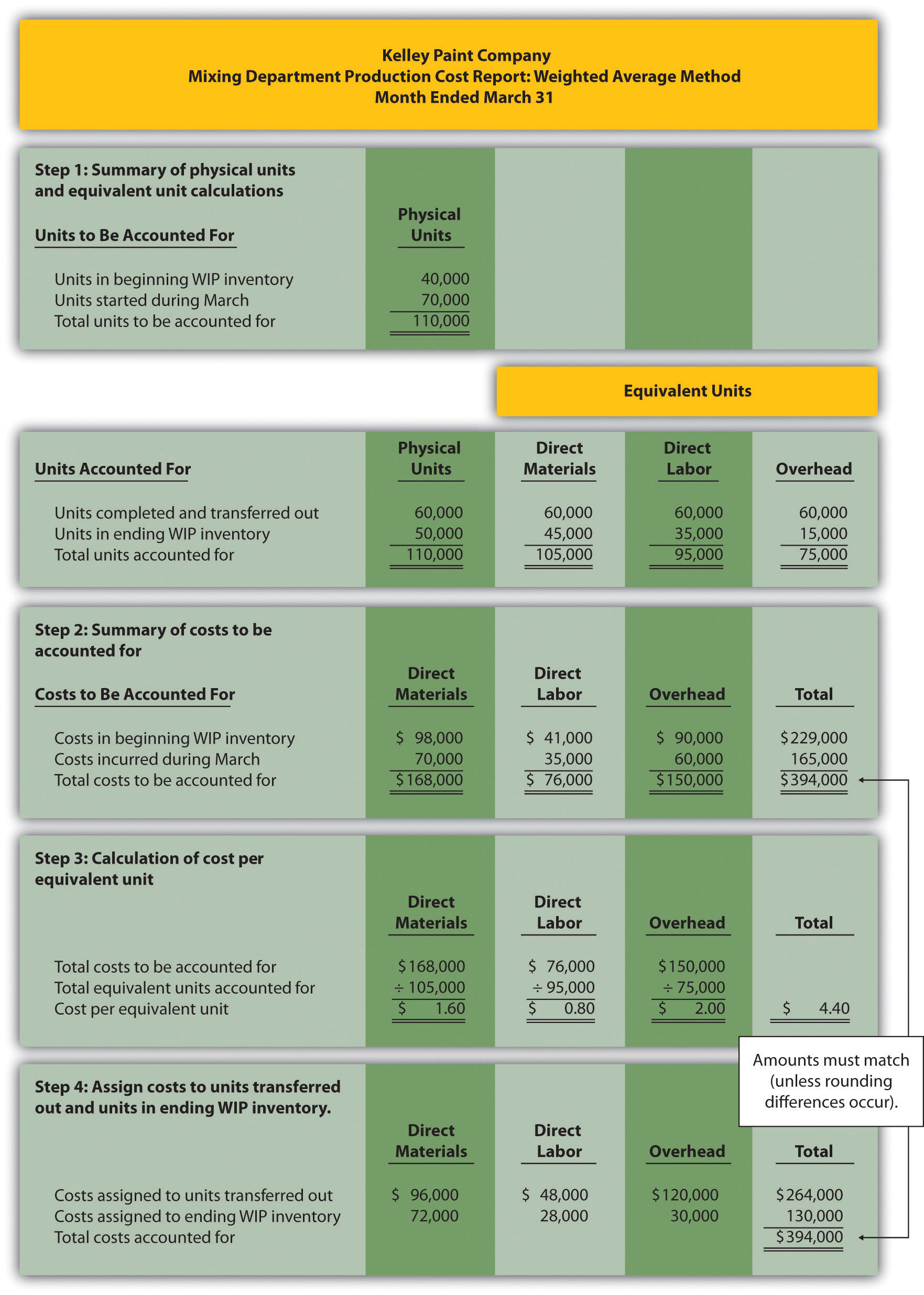

Preparing A Production Cost Report

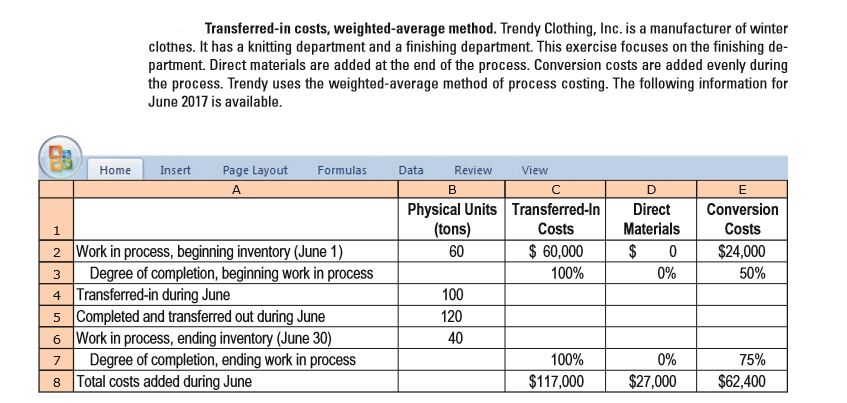

Answered Transferred In Costs Weighted Average Bartleby

Answered Data Section Percent Units Conversion Bartleby

Solved 3 Data 4 Beginning Work In Process Inventory 5units Chegg Com

Cost Of Goods Manufactured Template Download Free Excel Template

Inventory Formula Inventory Calculator Excel Template

Solved Beginning Finished Goods Inventory Beginning Work In Chegg Com

Cost Of Goods Manufactured Formula Schedule How To Calculate Guide

8 11 Equivalent Units Initial Period Financial And Managerial Accounting

8 4 Tracing The Flow Of Costs In Job Order Financial And Managerial Accounting

Work In Process Inventory Definition Calculation And Example Blog Efex

3 Types Of Inventory Raw Materials Wip And Finished Goods Youtube

Inventory Formula And Calculator