kansas vehicle sales tax estimator

Kansas has a 65 statewide sales tax rate but also. The Tax Calculator should only be used to estimate an individuals tax liability.

The treasurers also process vehicle titles and can register vehicles including personalized license plates.

. Marion County Treasurers office is now offering a new service that you can use to estimate the cost of your vehicle renewals or new. The sales tax varies greatly by location in kansas with the highest rate. Its fairly simple to calculate provided you know your regions sales tax.

This will start with a recording. If you are unsure call any local car dealership and ask for the tax rate. DO NOT push any buttons and you will get an.

Kansas Department of Revenues Division of Vehicles launched KnowTo Drive Online a web-based version of its drivers testing exam powered by Intellectual Technology Inc. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Administrative Fee 275 Retail 75 for AZ Plan 100 XD Plan Sales Taxes and Finance Charges are additional to the.

To calculate sales tax visit Kansas Department of Revenue Sales Tax Calculator. The minimum is 65. Average Local State Sales Tax.

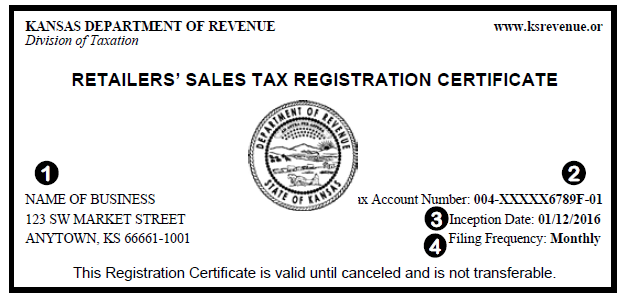

Vehicle transactions will incur 150 facility fee per vehicle when done in our office. A sales tax receipt is required if you have purchased the vehicle from a Kansas motor vehicle dealer. Kansas Vehicle Property Tax Check - Estimates Only.

Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle property. 137 average effective rate. Kansas 105 county treasurers handled vehicle registration tags and renewals.

Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. Vehicle Property Tax Estimator. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. Title fee is 800 tag fees vary according to type of vehicle. Multiply the vehicle price after trade-ins andor incentives by the sales.

Buy a new Ford F-150 truck or schedule auto service at our KS. Kansas Vehicle Sales Tax Estimator. Schools Special Hunting Opportunities.

The information you may need. Effective July 1 2002 if the vehicle is purchased in a taxing jurisdiction that has a lower. Vehicle Property Tax Estimator.

For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000. Dealership employees are more in. The sales tax in.

To use the calculators above including the car payments calculator NJ youll usually need to enter some basic information about the vehicle you plan to purchase. A mileage reading will still be required.

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Auto Loan Calculator With Tax Tag Fees By State

Kansas Car Registration Everything You Need To Know

Nj Car Sales Tax Everything You Need To Know

Kansas Department Of Revenue Business Tax Home Page

Tag And Taxes Treasurer S Office Reno County Ks Official Website

Kansas Clarifies Sales Tax Responsibilities For Remote Retailers And Marketplaces

Jay Wolfe Acura Kansas City Acura And Used Car Dealership

Kansas Department Of Revenue Division Of Vehicles Vehicle Tags Titles And Registration

Used Mazda Cx 5 For Sale In Kansas Cargurus

Motor Vehicle Crawford County Ks

Used Cars For Sale In Kansas City Mo Cars Com

Sales Tax On Cars And Vehicles In Kansas

State Use Program Kansas Department Of Administration

Kansas Car Registration Everything You Need To Know

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax